Polity

Election Commission also streamlining Index Card and Statistical Reports for faster sharing- PIB

The Election Commission of India (ECI) has introduced a streamlined, technology-driven system to generate Index Cards and post-election statistical reports. This marks a significant shift from the earlier manual system to a faster, automated mechanism aimed at enhancing data accessibility and transparency in the electoral process.

About Index Card

- It is a non-statutory, post-election statistical format developed by the Election Commission of India.

- Aims to improve transparency and accessibility of constituency-level election data.

- Covers data on candidates, electors, votes polled, vote shares, turnout, and gender-wise patterns.

- Facilitates generation of 35 reports for Lok Sabha and 14 for State Assembly elections.

- Includes performance data of national, state, and unrecognized political parties

- Designed to support researchers, media, academia, and policymakers.

- The upgraded system ensures faster, automated, and integrated reporting.

- Replaces the old method of manual data entry and physical index cards.

- Reports are non-binding and only meant for research and academic use.

- Final authoritative data remains with the Returning Officers in statutory formats.

International Relations

More ‘resources and efforts’ required to nurture India-Central Asia links- THE HINDU

External Affairs Minister Dr. S. Jaishankar hosted the 4th edition of the India-Central Asia Dialogue to explore economic growth and deepen ties. He stressed enhancing connectivity via Iran’s Chabahar Port and supported mutual trade settlements in national currencies to boost India-Central Asia trade.

Key Highlights of the India-Central Asia Dialogue :

- Financial Cooperation:

- Central Asian banks opened rupee vostro accounts in India.

- Proposal to use India’s UPI for cross-border payments.

- Trade & Connectivity:

- Focus on diversifying trade and improving transit procedures.

- Call to expand air services for better connectivity.

- Partner Commitments:

- Kazakhstan: Lauded India’s innovation, pledged stronger ties.

- Kyrgyzstan: Reaffirmed strategic partnership.

- Turkmenistan: Called India a key geo-economic partner.

India-Central Asia Ties

- Historical & Cultural Links:

India shares deep-rooted civilisational and cultural ties with Central Asia, dating back to the Silk Road era (3rd century BC–15th century AD). Buddhism, Sufism, and historical figures like the Kushans and Mughals reflect long standing engagement.

- Trade & Economy:

Cooperation focuses on energy, pharmaceuticals, textiles, and technology. Chabahar Port is key to boosting trade and investment flows.

- Connectivity Initiatives:

India promotes regional integration through the International North-South Transport Corridor (INSTC) and expansion of air services to enhance logistical and people-to-people connectivity.

- Security Cooperation:

Shared concerns over terrorism and Afghanistan's stability drive defense, intelligence sharing, and cybersecurity collaboration through platforms like the India-Central Asia Dialogue.

- Cultural & Educational Exchange:

Thousands of Central Asian students study in India, supported by tourism and diplomatic engagement, fostering strong grassroots ties.

Economy

RBI MPC’s 100 bps cut in cash reserve ratio to boost liquidity, lower cost of funds- Indian Express

The RBI’s Monetary Policy Committee (MPC) has announced a 100 basis points (bps) cut in the Cash Reserve Ratio (CRR) in four phases (25 bps each), reducing it to 3% by December 2025. This move is aimed at boosting liquidity and lowering the cost of funds in the banking system.

About Cash Reserve Ratio

The Cash Reserve Ratio (CRR) is the proportion of a bank’s total deposits that must be maintained with the Reserve Bank of India (RBI) in liquid cash. This amount cannot be used for lending or investment and earns no interest.

- Applicable only to scheduled commercial banks (not RRBs or NBFCs).

- It acts as a monetary policy tool to regulate liquidity and inflation.

Key Objectives of CRR

- Inflation Control: Raising CRR restricts bank lending, helping curb inflation.

- Liquidity Buffer: Ensures banks can meet sudden withdrawal demands.

Loan Benchmark: Acts as a base reference rate for determining loan interest.

- Economic Stimulus: Lowering CRR can infuse liquidity and boost economic activity.

Impact of CRR Cut

- Increased Liquidity:

- Will release ₹2.5 lakh crore into the banking system by end of 2025.

Banks can lend this amount, stimulating credit flow.

- Lower Borrowing Costs:

- Funding costs for banks will decline, allowing cheaper loans for consumers and businesses.

- Enhanced Credit to Priority Sectors:

- Will support MSMEs, agriculture, retail, and other priority sectors through increased access to credit.

- Encouragement for Investment and Growth:

- Improved liquidity and lower rates expected to boost private investment and domestic spending.

No Return Impact:

- RBI clarified that this liquidity injection would not affect banks' returns, encouraging lending.

- Improved Monetary Transmission:

- Easier credit conditions to improve interest rate transmission and stimulate economic momentum.

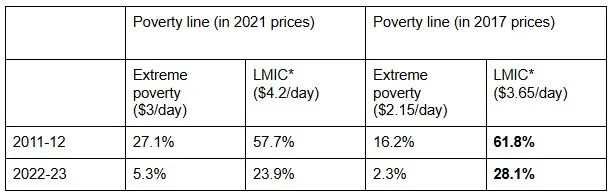

At World Bank’s raised poverty line of $3 a day- Indian Express

The World Bank has revised the global extreme poverty line from $2.15 to $3 a day, leading to a sharp decline in India's extreme poverty rate — from 27.1% in 2011-12 to 5.3% in 2022-23.

Key Points

- New LMIC Poverty Line: Revised from $3.65/day (2017 prices) to $4.20/day (2021 prices) by the World Bank.

- Poverty Rate Drop: Under the new LMIC line, poverty rate fell from 57.7% in 2011-12 to 23.9% in 2022-23.

- Absolute Numbers: People below the LMIC line declined from 732.48 million to 342.32 million over 11 years.

- India’s Population Estimate: World Bank estimates India’s population at 1,438.07 million in 2023.

- Adjusted Line Comparison: The revised $4.20 line is effectively lower than the inflation-adjusted $4.40, which explains the lower poverty estimate.

- Rural Poverty: Fell from 69% (2011-12) to 32.5% (2022-23) under the $3.65/day line.

- Urban Poverty: Declined from 43.5% to 17.2% in the same period.

- Education-Based Gap: In 2022-23, 35.1% of Indians without schooling lived below the poverty line, compared to 14.9% of those with post-secondary education.

- Upcoming Data: Updated poverty rates for 2023-24 will be released in October under the World Bank’s Poverty and Inequality Platform (PIP).

Multidimensional and Consumption-Based Poverty Trends in India

- Multidimensional Poverty Decline (World Bank): MPI-based non-monetary poverty fell from 53.8% in 2005-06 to 15.5% in 2022-23.

- MPI Indicators: Includes income/consumption, education (attainment & enrolment), drinking water, sanitation, and electricity.

- NITI Aayog Estimate: Multidimensional poverty reduced from 29.17% (2013-14) to 11.28% (2022-23).

- Rural Consumption Growth: Average monthly consumption rose from Rs 1,430 (2011-12) to Rs 2,079 (2023-24), a 45.4% increase.

- Urban Consumption Growth: Average monthly expenditure increased from Rs 2,630 to Rs 3,632, a rise of 38%.

- Source: Based on data from Household Consumption Expenditure Survey (HCES) 2023-24.

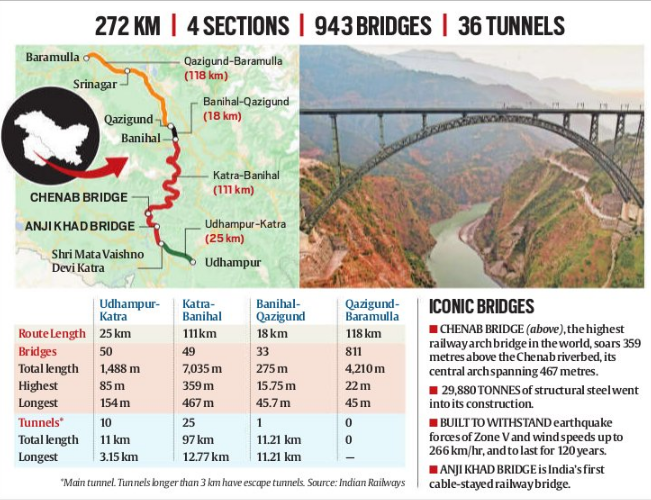

The Train to Kashmir- Indian Express

Prime Minister Narendra Modi flagged off two specially designed Vande Bharat Express trains between Shri Mata Vaishno Devi Katra and Srinagar on June 6.

Marks a key milestone in the completion of the Udhampur–Srinagar–Baramulla Rail Link (USBRL) project.

Historical Background

- First railway line in the Jammu and Kashmir princely state was built by the British in 1897.

- Earlier plans aimed to connect Jammu to Srinagar via Rawalpindi and Muzaffarabad, but these were disrupted due to Partition in 1947.

- The modern USBRL project was conceived in 1994 and declared a national project in 2002.

|

Chenab Bridge

|

Anji Khad Bridge

|

|

World’s Highest Railway Arch Bridge

- Stands 359 m above the Chenab riverbed, 35 m taller than the Eiffel Tower.

- Total length: 1,315 m; central arch span: 467 m.

- Built with corrosion-resistant steel suited for –10°C to 40°C.

- Designed to withstand Zone V earthquakes and 266 km/h winds.

- Engineered for a lifespan of 120 years.

- Represents India’s engineering prowess in high-seismic Himalayan terrain.

|

India’s First Cable-Stayed Railway Bridge

- Located in Reasi, spans the Anji River on the Katra–Banihal section of USBRL.

- Height: 331 m above the riverbed; total length: 725 m.

- Supported by 96 high-tensile cables and a 193 m inverted Y-shaped pylon.

- Designed for complex geological and steep valley conditions.

- Ensures connectivity in challenging terrains of Jammu & Kashmir.

|

Strategic & Developmental Significance

Strategic Importance

- Provides all-weather rail connectivity to Kashmir Valley.

- Enhances the movement of troops and logistics, crucial from a national security perspective in a border-sensitive region.

Economic & Social Impact

- Facilitates trade and movement of goods from Kashmir to other states.

- Boosts tourism and pilgrimage traffic (e.g. Vaishno Devi, Amarnath).

- Reduces travel time and cost for both freight and passengers.

Regional Integration

- Helps integrate the Kashmir Valley with the rest of India by:

- Connecting remote districts to the national economy.

- Enabling faster delivery of public services and emergency response.

- Strengthening emotional and economic unity.