Environment

Green India Mission to increase forest cover, address climate change - Indian Express

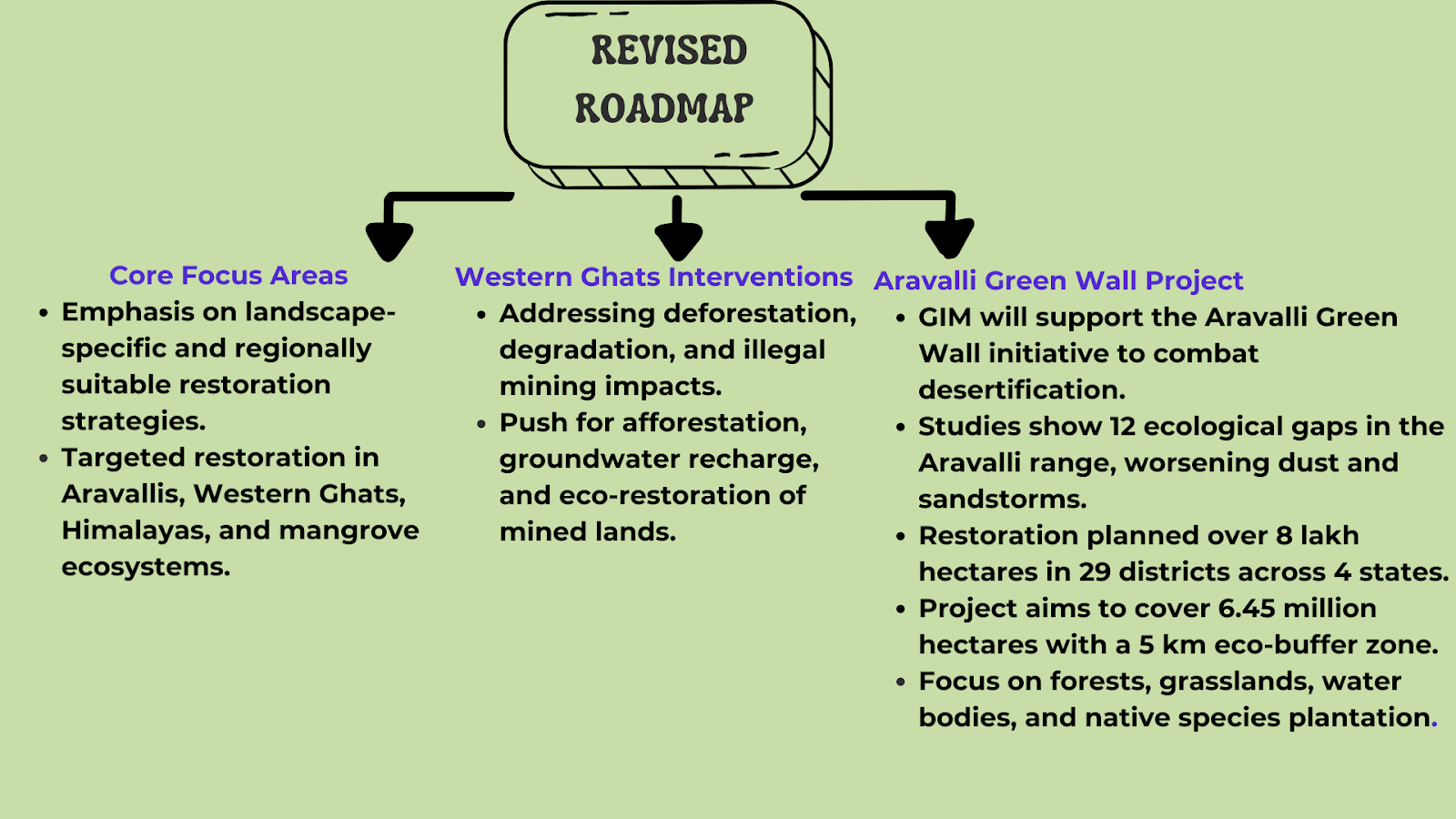

The Centre released an updated roadmap for the Green India Mission (GIM), aiming to restore and expand forest cover, mend degraded lands, and enhance ecological resilience by focusing on the Aravalli Ranges, Western Ghats, Himalayas, and mangroves

Key Achievements Of Green India Mission (GIM):

- Launched in 2014 as part of India’s National Action Plan on Climate Change (NAPCC).

- Aims to increase forest/tree cover on 5 million hectares and improve forest quality on another 5 million hectares.

- Focuses on ecological restoration and climate change mitigation.

- Seeks to enhance livelihoods of forest-dependent communities.

- 11.22 million hectares covered through afforestation activities (2015–16 to 2020–21).

- ₹624.71 crore released to 18 states between 2019–20 and 2023–24.

- ₹575.55 crore utilized, showing a high implementation rate (~92%).

- Plantation done through a mix of central and state schemes.

- Targets sustainable ecosystem management and biodiversity conservation.

Revised GIM combat will land degradation and desertification

- Extent of Degradation: Around 97.85 million hectares (about 30% of India’s land) were degraded in 2018–19 (ISRO Atlas).

- Climate Commitment: India aims to create an additional carbon sink of 2.5–3 billion tonnes CO₂ through forest and tree cover by 2030 (UNFCCC submission).

- Natural Barriers: Forests, grasslands, wetlands, and mountain ecosystems will serve as natural carbon sinks and climate buffers.

- Role of GIM & Green Wall: GIM and projects like the Aravalli Green Wall are central to achieving these restoration and carbon sink targets.

Green hydrogen: Govt, industry bullish, but demand falters amid global headwinds - Indian Express

India’s green hydrogen sector is witnessing strong government and industry backing, but global geopolitical instability, policy reversals, and weak export demand are delaying the sector’s expansion — despite ambitious plans and policy frameworks in place.

Strategic Domestic Pivot in Green Hydrogen Development

- Amid weak global demand due to geopolitical tensions and uncertain international policies, India has shifted focus from exports to strengthening its domestic green hydrogen ecosystem. The government and industry remain optimistic about its long-term potential, particularly in decarbonising key sectors such as fertilisers, steel, and shipping.

- To build internal demand, pilot projects are being launched across these sectors, supported by investments in infrastructure, policy frameworks, and market development.

National Green Hydrogen Mission

Launched in 2023, the National Green Hydrogen Mission aims to establish India as a global hub for green hydrogen production, utilization, and export.

- Budget Outlay: ₹19,744 crore

- Target: 5 million metric tonnes (MMT) of green hydrogen production capacity by 2030

- SIGHT Programme: Supports domestic electrolyser manufacturing to reduce import reliance

- In April 2025, the MNRE introduced a certification framework to ensure standardised, transparent measurement of green hydrogen at production sites.

Private Sector Response to Green Hydrogen- While firms like ReNew (Odisha), Sembcorp, and ACME have expressed interest, most are reluctant to invest without assured offtake agreements due to cost and demand uncertainties.

Strategic Focus on Green Ammonia: Green hydrogen is being prioritized for conversion to green ammonia (hydrogen + nitrogen), which has applications in fertilizers and as low-carbon shipping fuel.

To reduce dependence on imports, India may need to expand domestic production of ammonia.

Economy

FASTag annual pass at Rs 3,000 for ‘hassle-free highway travel’ - Indian Express

The Minister of Road Transport and Highways has introduced a FASTag-based annual pass worth ₹3,000 to enable seamless and convenient travel on highways.

About the New FASTag-Based Annual Pass:

- The FASTag-based annual pass will be launched on August 15 and will remain valid for one year or 200 trips, whichever is earlier.

- Definition of a Trip: One-way crossing at point-based toll plazas = 1 trip; round trip = 2 trips; entry-exit pair at closed tolling = 1 trip.

- Mandatory Status: The annual pass is optional; regular FASTag usage continues unchanged.

- Vehicle Eligibility: Applicable only for private non-commercial cars, jeeps, and vans.

- Plaza Coverage: Valid only at National Highways & Expressways managed by NHAI, not on state or local toll roads.

- Validity: Pass is valid for one year or 200 trips, whichever comes first.

- The initiative aims to enhance user convenience by reducing waiting time, easing traffic congestion, and minimizing disputes at toll booths, thereby ensuring faster and smoother travel for private vehicle users.

What is FASTag?

- FASTag is an electronic toll collection system operated by the National Payments Corporation of India (NPCI) in collaboration with the National Highways Authority of India (NHAI).

- A FASTag sticker is affixed to the vehicle’s windscreen and uses Radio Frequency Identification (RFID) technology to communicate with scanners at toll plazas.

- When the vehicle crosses a toll gate, the toll amount is automatically deducted from the user’s linked bank account or prepaid wallet, eliminating the need for manual payments.

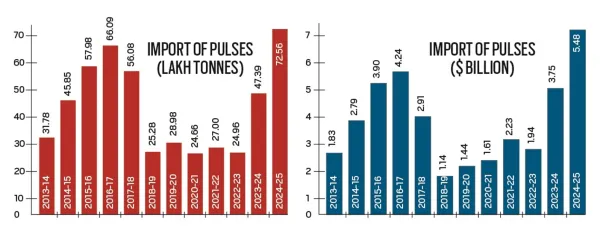

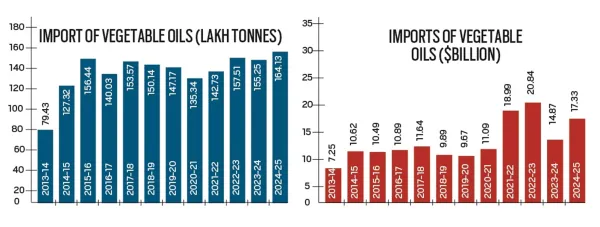

Cost of Pulses and Oil Import - Indian Express

India’s imports of pulses and edible oils have touched record highs in 2024–25 (April–March), highlighting rising dependence on imports despite significant domestic production — due to unremunerative prices for farmers, rising CPI inflation, and skewed MSP-to-market price differentials.

Rising Imports:

- Pulses imports increased to 37.1 lakh tonnes in 2024–25 — up from 6.6 million tonnes (mt) in 2016–17.

- Edible oil imports rose to a record 164 lakh tonnes in 2024–25, up from 79 mt in 2012–13.

- In value terms, pulses imports rose from $1.7 billion (2017–18) to $5.48 billion (2024–25); edible oil imports touched $13.93 billion.

Farmer Concerns:

- Farmers get market prices below MSP (e.g., ₹6,500 for green gram vs MSP of ₹8,682).

- Pulses and oilseeds are less preferred due to price uncertainty, import competition, and lack of procurement at MSP.

- Many prefer crops like paddy or wheat where procurement is assured.

Price-Market Disconnect:

- Prices of key crops (tur, moong, urad) have remained below MSP, despite production costs rising.

- Soybean sells at ₹3,400–₹4,200/quintal vs MSP of ₹4,892.

- Green gram often trades ₹2,000 below MSP

Global Factors:

- Import spike in 2022–23 due to Russia-Ukraine war disrupting supply chains.

- Major suppliers of edible oil: Indonesia, Malaysia, Brazil, Argentina, Ukraine.

- USDA reports lowered import duties in India on soyabean, sunflower and canola oil to ease prices.

Inflation Concerns:

- CPI inflation in vegetable oils: Rising again since Nov 2024.

- May 2025 CPI: Vegetable oils inflation at 13.9%, pulses at 17.9%.

Defence

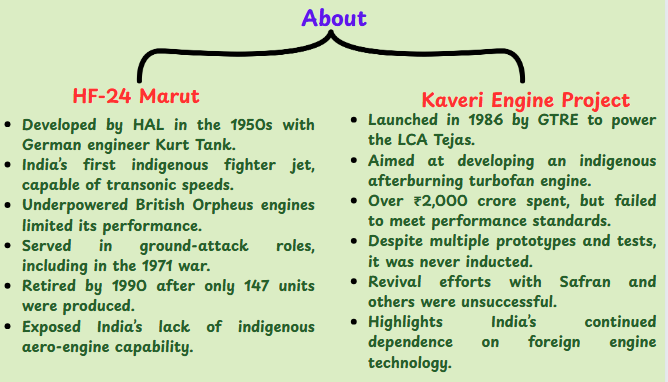

Why India should address its propulsion gap - The Hindu

India’s AMCA program is progressing, but renewed concerns over engine dependency persist due to delays in foreign deliveries and failed indigenous efforts like the Kaveri engine. Stalled technology transfer deals highlight the urgent need to bridge the propulsion gap for strategic self-reliance.

Why It Matters

- Engine Dependency:Delays in foreign engine supplies, such as the U.S.-made GE F404 for LCA Mk1A, have exposed critical vulnerabilities in India’s defence preparedness and timelines.

- Import Bottlenecks:India’s continued reliance on imported engines for land, air, and naval platforms—including tanks, submarines, aircraft, and ships—poses a significant strategic risk.

- Impact on Future Projects:Key initiatives like the fifth-generation AMCA fighter jet face potential setbacks if India fails to achieve engine self-reliance.

Strategic Importance:

Developing indigenous propulsion systems is essential not just for improving military readiness and reducing external dependence, but also for insulating India’s defence sector from geopolitical uncertainties. It's a vital national security necessity, not merely a technological goal.